Whether in Spruce Grove, Stony Plain, Parkland County, the Edmonton area or elsewhere, REALTORS® love statistics. We like to know how many and what kind of properties are being listed and sold, and for how much. We also like to examine trends over time because this helps us help our clients determine realistic property values when they buy or sell a home.

Whether in Spruce Grove, Stony Plain, Parkland County, the Edmonton area or elsewhere, REALTORS® love statistics. We like to know how many and what kind of properties are being listed and sold, and for how much. We also like to examine trends over time because this helps us help our clients determine realistic property values when they buy or sell a home.

We often hear about the ups and downs of the real estate market, but what does this really mean? Is real estate a good investment? Does real estate always appreciate?

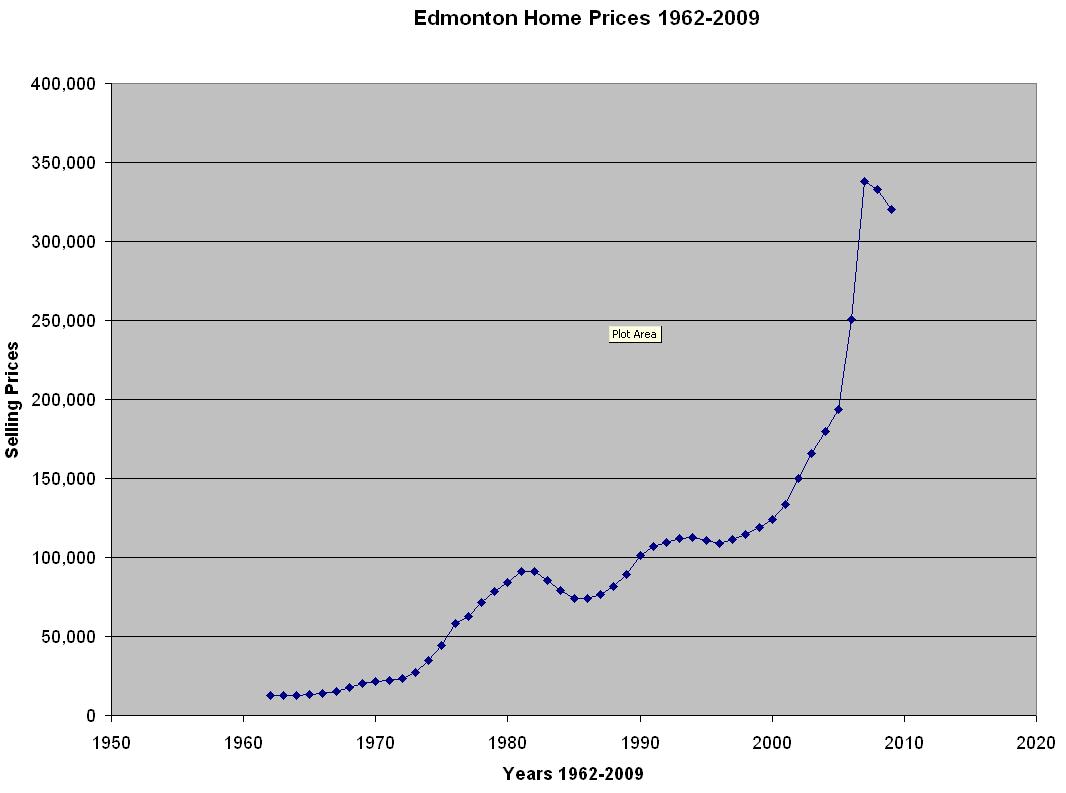

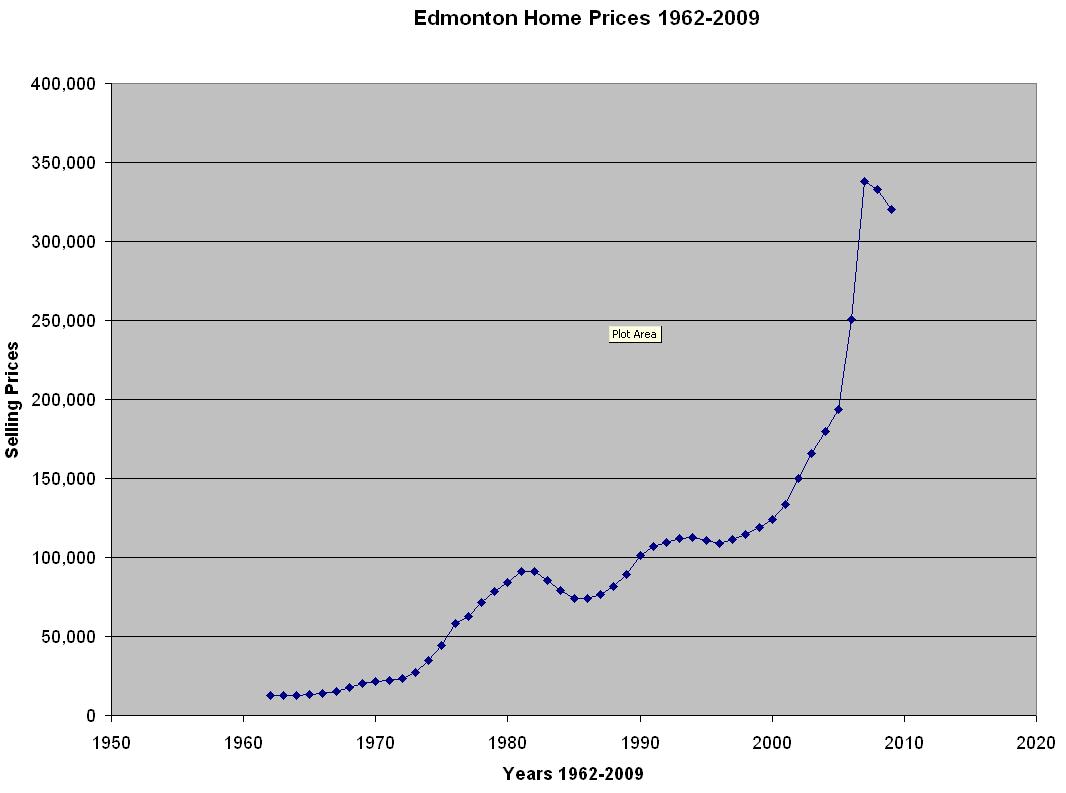

Answers to these questions can be seen fairly easily by looking at a few statistics, especially when these are presented in graphic format. If we look at the average residential selling prices for homes in the Edmonton area from 1962 to 2009, we’ll see some interesting trends. Even more interesting is that these trends tend to repeat themselves.

From 1962 to 2009 the average selling price of a residence in Edmonton increased from $12,556 to $320,392 – an increase over 47 years of 24 times the starting value! Does this mean that the value of one’s home doubles every few years?! Well, sort of… Examining the numbers year by year, we see that while the overall price trend has been ever higher, the movement is not always steady and not always upward. There were a number of times during those 47 years when the average selling price in one year, or even for a series of years, was lower than the previous year.

Prices stumbled in 1964, recovering the next year. Steady, and in some cases significant growth, continued until 1981. Looking more closely at the gains during those 16 years, and doing a little math, we discover that double digit percentage gains over the previous year occurred in 1967 (12.3%), 1968 (12.9%) and 1969 (17.7%). During the next 3 years prices continued to increase but at a more modest rate. 1973 saw prices take another leap (14.6%), and that was followed by 3 more years of huge year over year gains (1974 – 28.2%; 1975 – 26.4%; 1976 – 32%). A house that sold in 1972 for $24,777 was suddenly “worth” $59,450 only 4 years later. By 1981 the average selling price had risen to $91,438, a gain of 369% in just 9 years. Many people buying and then re-selling property during this time made substantial financial gains.

But the sometimes cruel nature of the real estate market took over in 1981. A person buying a home in 1981 would have seen prices drop for the next 4 years, and then increase modestly for another 4 years but still not rebound to the price paid in 1981. A hard lesson perhaps.

By 1990 the average residence sold in Edmonton for $101,014. Prices rose for 5 years, fell in 1995 and 1996, and then rose for the next 11 years, up to 2007. This is eerily reminiscent of the trend mentioned above starting in 1964. Several of the 11 years between 1997 and 2007 saw a price gain that was dramatic. In 2002 and 2003 percentage increases were 12.6% and 10.2% respectively. In 2006 prices rose 29.4%. This was followed in 2007 by the largest one-year percentage increase since these statistics began: 34.7%, or a rise to a dollar value of $338,009. Most people are probably aware of what happened to the housing market in the US during this period of time and its effect on house prices throughout North America. The average selling price of a home in Edmonton dropped 1.5% in 2008 and 3.7% in 2009 but appears to be trending upward so far in 2010.

These trends are even easier to spot in a chart like this one:

Looking at the proverbial big picture, we see the following:

- The average annual price increase is roughly 7.8%

- The average 5-year price increase is about 49%

- Only 9 years between 1962 and 2009 showed price decreases

- If you held a property for 9 years, you would always see an increase

- Edmonton values appear to double every 9 years, on average, since 1962

Statistics and facts suggest that yes, real estate is definitely a good investment, and yes, it does appreciate over time.

What about right now in the marketplace? Are we once again in the trend of a couple years of soft prices followed by a decade of increases? Are prices going to continue to fall before they recover as they did in the 1980s and 1990s? Is now a good or bad time to buy and sell? Hard to predict and impossible to know. This is, of course, exactly what makes real estate interesting!

Interested in learning more about the real estate market in Spruce Grove, Stony Plain, Parkland County or the Edmonton area? Phone me at 780-910-9669, email me at barry@barryt.ca, or contact me here.

Do I have to get a home inspection?

Do I have to get a home inspection? For more information on this topic within my website:

For more information on this topic within my website:

My clients in Spruce Grove, Stony Plain, Parkland County and the Edmonton area have lots of questions, and I’m happy to answer them! This article is Part 1 of a series that addresses the most common questions I get from home buyers.

My clients in Spruce Grove, Stony Plain, Parkland County and the Edmonton area have lots of questions, and I’m happy to answer them! This article is Part 1 of a series that addresses the most common questions I get from home buyers.

Whether in Spruce Grove, Stony Plain, Parkland County, the Edmonton area or elsewhere, REALTORS® love statistics. We like to know how many and what kind of properties are being listed and sold, and for how much. We also like to examine trends over time because this helps us help our clients determine realistic property values when they buy or sell a home.

Whether in Spruce Grove, Stony Plain, Parkland County, the Edmonton area or elsewhere, REALTORS® love statistics. We like to know how many and what kind of properties are being listed and sold, and for how much. We also like to examine trends over time because this helps us help our clients determine realistic property values when they buy or sell a home.